Trying to transfer money internationally to and from the Netherlands means one thing: fees, fees, and more fees.

In fact, everyone wants a cut: there are transfer fees, conversion fees, and sometimes even fees just to receive the cash — nee, dank je wel!

The good news is that these hefty fees are absolutely avoidable.

Cheap money transfers to and from the Netherlands are your new reality, baby — and we’re here to show you how!

This post might have affiliate links that help us write the articles you love, at no extra cost to you. Read our statement.

In a rush? Our top choice money transfer service in the Netherlands is Wise, because:

- Their exchange rates offer you the most bang for your buck

- Their handy dandy Wise card lets you bank with ease in 50 countries

- Their website and services are a breeze to navigate

- The quick guide: how to transfer money to and from the Netherlands (and save money)

- 6 tried-and-tested ways to transfer money in the Netherlands, reviewed and ranked

- International money transfers: what to look out for

- Ways to transfer money to and from the Netherlands

- International money transfer services explained

- Money transfers in the Netherlands: frequently asked questions

The quick guide: how to transfer money to and from the Netherlands (and save money)

Let’s get down to business with five easy steps to transferring money to or from the Netherlands cheaply and safely. 👇

- Sign up for a money transfer service such as Wise (this is our top pick and one that we use personally!)

- Choose the amount of money you want to send and in which currency.

- Add the recipient’s bank details.

- Verify your identity.

- Pay for your transfer, take a breath, and kick back.

Warning! Some money transfer services in the Netherlands will rip you off on the exchange rate with hidden fees or charges, or will take days to transfer. We’ve researched the cheapest, quickest, and most trustworthy services below!

6 tried-and-tested ways to transfer money in the Netherlands, reviewed and ranked

All of the below options offer excellent exchange rates and fast transfers and are regulated under national frameworks.

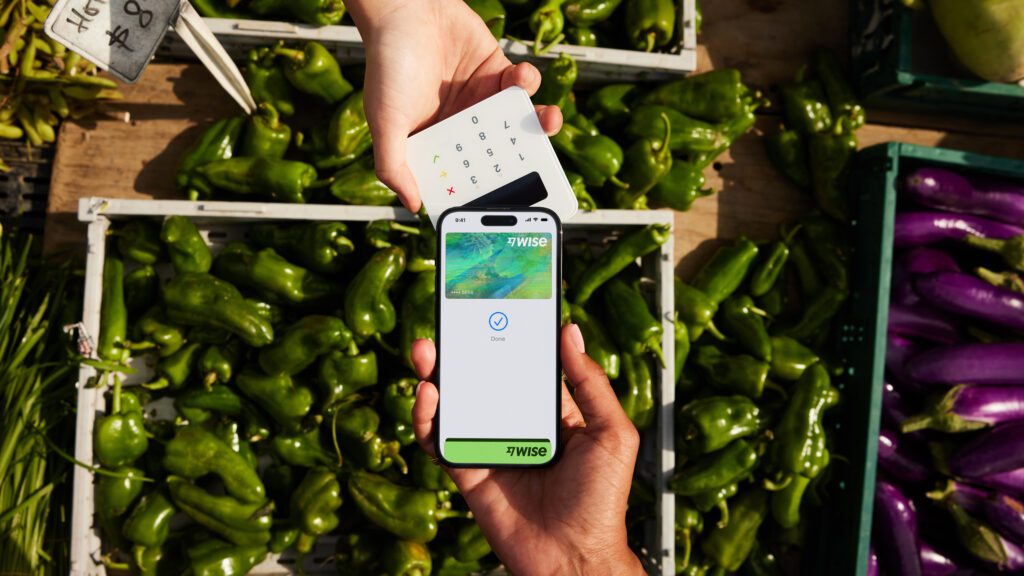

1. Wise: our number one pick to transfer money internationally

What we like most about this company is that Wise’s exchange rates are as close to the mid-market rate as possible — meaning you get more bang for your buck. Coupled with handy extra features and ease of use, we’re definitely fans!

As internationals who live in the Netherlands, we also like the Wise card that lets you spend money like a local in 50 different countries, the app’s transaction notifications, and the ability to get bank account details in 10 different countries.

2. CurrencyFair: transparent and easy to use

CurrencyFair makes it into our top three thanks to its low fees and transparent, easy-to-use website. However, while they offer two handy ways to change currencies (immediate rates or peer-to-peer rates), CurrencyFair is primarily suited for North America, Europe, and Oceania users.

In addition to this, it’s also not possible to transfer money directly via credit or debit card, so you need to have your bank details handy.

3. Xe: a leader in the field of international money transfers

With 20-plus years of experience with foreign currencies, Xe offers competitive rates and is particularly suited for people looking to send more than €250 at a time.

Xe is definitely one of our top picks for sending money to and from the Netherlands, but their website’s user-friendliness for doing international money transfers could be better. Their website and bonus features are also mainly focused on currency/exchange rate literacy.

4. Moneycorp: the best pick for large transfers to and from the Netherlands

A veteran in the field of online international money transfers, Moneycorp offers a wide array of resources to keep you (and your money) up to speed with the latest exchange rate developments.

They’re best suited for larger transfers as they don’t have any percentage fees but instead charge a small markup. That also means you’ll benefit from planning your transfers in advice so they can help you get the very best exchange rate

5. Revolut: the neobank that doubles as a money transfer service

Despite being the only option on our list that’s more of a bank than a money transfer service, Revolut is ideal for small to medium money transfers. They’re easy, fast, and cheap — but make sure you plan your transfers on weekdays if you want the best rates.

As a neobank, Revolut naturally offers a variety of features aside from international money transfers. Unfortunately, Revolut isn’t known for its customer service and doesn’t have ideal help available when it comes to money transfers.

6. TransferGo: the best choice for live exchange rates

Supplying a whopping 22 currencies across 47 countries, TransferGo is a rock-solid choice for sending money to and from the Netherlands. Their exchange rates are live and super-competitive, making your transactions as close to the market average as possible.

However, TransferGo may not be ideal for super-speedy bank transfers across continents. Customers making money transfers to or from 10 countries (such as the US and Canada) will experience delivery times around 1 business day longer than others.

International money transfers: what to look out for

Generally, transferring money within the EU doesn’t cost much (if anything) if the payment stays in euros.

However, as soon as you transfer money to or from a country that has a different currency, you’ll encounter some heavy fees.

But before fleeing from the excessive rates of the bank, let’s learn how to spot them. 👀

Exchange rates on international money transfers

The exchange rate you receive on an international money transfer isn’t as simple as the rate you see on Google or on the news.

Instead, many transfer providers skim money off the top by providing an exchange rate that’s lower than the mid-market rate that you see on the web or on the news. Hence, always check the end product of how much money will be sent or received.

Hidden fees and charges

When transferring money internationally through your bank, they’ll often charge a fixed fee for the service — in addition to the money they make on the exchange rate.

Note that, sometimes, the bank will charge a very low fee but have hidden markups. 🙃 Essentially manipulating the price you pay for the transfer service through the exchange rate — often without you noticing.

How to spot a currency conversion markup: If the current exchange rate is €1.13 per USD and the transfer service offers you €1.00, that means you’re being charged €0.13 for every single euro you transfer!

Speed of the transfer

Another thing affecting how much you pay for moving money to and from the Netherlands is the speed of the transfer.

Normally, it takes one to five business days for the money to whoosh across a country/continent/ocean but some snazzy services guarantee a lightning transfer in less than an hour!

Ways to transfer money to and from the Netherlands

Okay, by now, you’ve gathered there are a few ways to send money abroad. But what’s the easiest? The cheapest? The fastest? Allow us to explain.

Using online international money transfer services

Online international money transfer services are companies like Wise. They beat the banks to generally easier, always cheaper, and often faster money transfers. 🎉

How? The main difference between an online international money transfer service and a bank is that an online service offers the actual mid-market exchange rate, whereas banks overcharge you through markups and hidden fees — ja, echt.

You sign up with an online money transfer service on their website or via an app and then simply follow their instructions to send off your money. Online international money transfer services tend to operate very similarly to each other, so what you need to keep an eye out for is their exchange rates!

Luckily, (and unlike banks) online international money transfer services are transparent with their fees and the final cost of your transfer is easy to spot and compare.

Sending money internationally via a neobank (like bunq or Revolut)

If online international money transfers aren’t your cup of tea, but you also don’t want to be ripped off by a traditional bank, then a neobank might be for you. A neobank is a fully digital bank such as bunq, N26, or Revolut.

READ MORE | New to the Netherlands? 7 reasons why bunq is the perfect bank for expats

Aside from not having a physical branch and being much more flexible, neobanks differ from traditional banks as they often partner with an online money transfer service.

Both bunq and N26 partner with Wise, meaning you’ll be set up with one of the best online international money transfer services without having to as much as lift a finger!

Revolut, on the other hand, doesn’t partner with anyone. While they don’t provide the mid-market exchange rate (and hence have a small markup), they don’t charge any other fees — so, it’s still cheaper than using a traditional bank for your transfers.

Although the specifics of an international money transfer differ a little depending on which neobank you use, sending money via a neobank is generally just a few clicks away using the bank’s in-app features.

Doing an international transfer via your traditional bank

Okay, we might not be super positive about traditional banks’ way of handling your international money transfers but let’s have a look anyway, shall we?

READ MORE | These are the best banks for expats in the Netherlands

Doing an international money transfer via a traditional bank is the default for many — and we understand why! It feels familiar, comfortable, and safe. And it is. It’s just not cheap. 😅

Generally, you go to your online banking portal and select ‘international transfer’ before providing the relevant information (the amount of money, currency, receiver details etc.). Then you’ll be asked how you wish to pay for the costs from your bank account.

With a traditional bank, you’ll have to choose who pays for costs associated with the transfer: you, the receiver, or splitting the cost between the two. Additionally, you’ll need to pick when you want the money transferred and what type of transfer (for example, an EU transfer).

After that, just wait for the money to arrive in the receiver’s account.

Let op! Some banks in the Netherlands, such as ING, can’t even transfer money internationally from your Dutch bank account. Instead, they ask you to use a third-party service.

Sending money through a wire service

The last way to transfer money to or from the Netherlands is by using a wire service such as Western Union or Moneygram.

Both of these services operate in the Netherlands, so you can easily show up at any of their physical locations.

This way of sending money personally means you can send cash whenever need be. However, it’s not always convenient and almost never goedkoep (cheap).

Additionally, while wire services have entered the 21st century and do offer services online, they are outcompeted by services such as Wise, which specialise in online international money transfers.

International money transfer services explained

Some of those online international money transfer services sound pretty good, right? If you’ve decided on your favourite already — awesome! Here comes the nitty-gritty stuff. 🧐

How to make an international money transfer

Got people waiting for you or bills stacking up? Laten we gaan! (Let’s go!).

👩💻 1. Open an account

The first step to making an online international money transfer is to open an account with your chosen service (our personal choice is Wise). You can do this via their website or an app, depending on who you choose to wire money through.

Opening an account tends to be free, easy, and fast — our three favourite words. 💃

👋 2. Confirm your identity

While not mandatory for all, many transfer services will ask to see some sort of ID before you can make your first money transfer. So, have your passport or national ID card handy!

💸 3. Choose the amount of money to send and its currency

Type in the amount of money in the currency you want to send, and the currency you want it converted to.

Here, most pages will show you the cost of the transfer (and the best will even include a breakdown of those costs for full transparency).

🏃♂️ 4. Select delivery speed

This is where things get interesting. When making an online international money transfer, you can select multiple “speeds” for your transfer.

Most services will have a few options that determine how fast your money will whoosh to the recipient’s account — but let op, typically the faster the transfer, the more money you pay.

✍ 5. Add recipient details

Who’s the lucky receiver? Make sure to have their full name, IBAN or account number, and sometimes their contact details ready.

💳 6. Pay up

Finally, pay the amount of money you’ve chosen to transfer, along with any additional costs from the online money transfer service.

Some services have more payment options than others but you can count on at least being able to pay either via credit or debit card, or a regular bank transfer. Sometimes, you may need to provide a payment reference.

🏁 7. Complete the transfer

Congratulations! You just finished your first online international money transfer! Now all you have to do is wait for the money to clear the transfer service and reach the recipient’s bank account.

Once that happens, you’ll get a notification from the transfer service.

How to receive an international money transfer

Oh, the satisfaction of seeing money trickle into your account — let us know if you’d like our bank details! 😉

🤝 1. Provide your details to the sender

Really, when receiving an online international money transfer, your part is easy. All you need to do is make sure you give the person transferring you the money the correct bank and contact details.

Good to know: Often, you need to provide a SWIFT code when sending or receiving international transfers. A SWIFT code is an 8-11 character code used to identify your financial institution around the world. It makes international transfers faster as it helps banks process the transaction — swiftly. 😉

🎉 2. Wait for a notification… and enjoy!

Once the money has been deposited in your account, you’ll likely receive a notification to inform you the transaction has been successful. And that’s it — time to start spending.

The costs involved in a money transfer to the Netherlands

By now, you know that using an online international money transfer service is the cheapest way to send money to and from the Netherlands.

However, it’s always best if you know exactly which costs are involved.

These depend on:

- Which currencies you are changing between: The costs of money transfers in the Netherlands depend most heavily on exchange rates (i.e. the value of the euro compared to other currencies).

- How much money you are transferring: Sending larger amounts will cost you more per transfer but is cheaper in the long run. Think of it as buying in bulk at the supermarket.

- The speed of the transfer: If you want to transfer money fast, you better budget it.

- The transfer company’s fee: This is how the online money transfer service makes its main income, so remember to factor in the transfer fee and any additional charges when sending money to the Netherlands or abroad.

Tips on transferring money cheaply: To save on costs when transferring money internationally, make sure that the transfer service is operating from the mid-market exchange rate, send larger amounts at a time, don’t pay for fast transfers but plan in advance, and compare different services to guarantee that you’re getting the most out of your money.

How secure is an international money transfer?

Rest assured that using an online international money transfer service is safe and protected by EU regulations. Amongst others, this regulation:

- makes it easier and safer to use internet payment services;

- better protects consumers against fraud, abuse, and payment problems;

- promotes innovative mobile and internet payment services;

- and strengthens consumer rights.

Nevertheless, it’s always a good idea to read up on the transfer service before using it, check reviews, and look at their security information (which should be available on the service’s website).

How do you prefer to conduct money transfers in the Netherlands? Tell us in the comments below!

Money transfers in the Netherlands: frequently asked questions

How can I transfer money to a Dutch bank account?

How can I transfer money internationally from my Dutch bank account?

You can transfer money to a foreign account from your Dutch bank account by making an online transfer via your own bank. However, it’s cheaper to use an online international money transfer service such as Wise.

What’s the best way to transfer money internationally?

The best way to transfer money internationally is by using an online international money transfer service. Online transfer services beat the banks’ prices, and provide fast, easy, and cheap transactions while guaranteeing your safety.

How can I get the best exchange rate on an international money transfer?

To get the best exchange rate on an international transfer, make sure the transfer service you’re using is operating based on the mid-market rate.

How can I make an international money transfer from the Netherlands?

To make an international money transfer from the Netherlands, set up an account with an online international money transfer service, choose the amount of money you want to send and in which currency, add the recipient’s bank details, verify your identity, and pay for the transfer. That’s it!

How long does an international money transfer take?

Generally, it takes one to five business days for an international money transfer to reach the recipient’s bank account. However, some online international money services can get it there as fast as an hour! Be aware that you often pay for the speed of a transfer.

How can I save money on an international money transfer?

The best tested and tried way to save money on your international money transfers is using an online service such as Wise. Online international money transfer services offer better exchange rates and charge lower fees than traditional banks.

Editor’s Note: This article was originally published in March 2022, and was fully updated in December 2023 for your reading pleasure.

Disclaimer: DutchReview does not provide financial services or advice, if you need advice, seek an expert.

[…] Initially the bank may tell you the cost to transfer, however there is nearly always an additional cost on top of this (in the small print or stated nowhere). On top of that sometimes the receiving bank (the bank you are transferring money into) also charges you. Read more from dutchreview.com… […]

Nice post. Transferwise is indeed amazing. It’s saved me more money than I care to think of. Other great alternative is Revolut.

Indeed Revolut is great.

Especially to move money from UK to NL(or any other sepa country).

With Revolut you get a UK account number for GBP and an IBAN for EUR in one app.

Everything for free. No monthly fees for the account, no cost for converting (on weekdays).

A debit card costs 6 EUR if you want

Use transfer wise.its brilliant,secure and easy. I move money from the uk to the Netherlands all the time. This is a genuine post- they’re not paying me!

Hi – Could you also advise how much can you bring and what is the tax implication on the same. Example –

I have 50K from my previous Indian employer in the bank. I am the only child and I have received another 100K from my parents after selling everything at there end.

So In total I have to bring 150K, what is the tax.

Please note the above example is a hypothesis.

The TransferWise has no services if money transfer from India to Netherlands. It’s a big problem and many times only bank are the option

If anyone knows and other option, please mention except western union

Interesting and useful article. However, could somebody explain why so very few Dutch merchants, publishers accept credit card payments whereas other countries all over the world do?